- Solutions

Technology Consulting

Product Engineering

From ideation to product launch, leveraging cutting-edge technologies to deliver innovative, scalable, and market-ready solutions.

Process Engineering

Tailored solutions to optimize & streamline business processes, enhancing efficiency, productivity, & operational performance

Digital Infrastructure Planning

Seamless integration of technology resources, enabling robust & scalable digital ecosystems tailored to your organization's needs

Technology Building

Web Application

Craft innovative, user-centric solutions that drive engagement, efficiency, & growth for your business

Mobile Application

Intuitive, high-performance apps across iOS & Android platforms, driving engagement & delivering exceptional user experiences

RFID System

Solution for tracking, monitoring, & management of assets, enhancing operational efficiency and security

Cloud DevOps

Systems with rapid deployment, scalability, and reliability in cloud environments

System Modernization

Upgrade legacy systems, enhance efficiency, security, & performance for seamless business operations

eGovernance Solutuons

GIGW Web Portal

Secure, user-friendly, & accessible web portals adgering to GIGW guidelines

CERT-In / STQC Audit

Comprehensive security audits & certification complied with CERT-In & STQC

Budget Management System

Budget monitoring, digitization of the demand requisitions, DSC based approvals, user defined workflows

Legal Case Management System

Manage all your legal cases, hearings, cause lists, history, documents & tasks at one place with intuitive dashboards & alerts

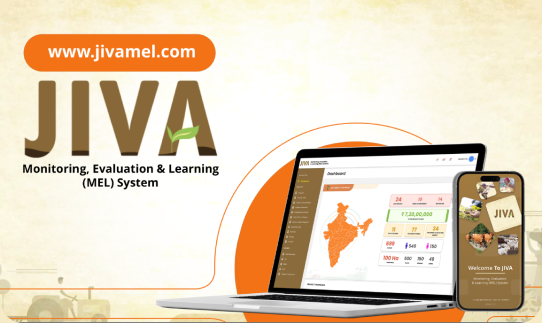

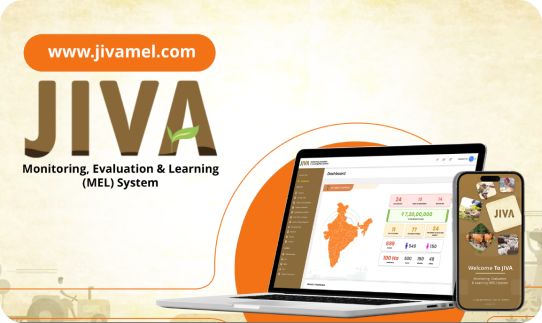

MEL (Monitoring, Evaluation & Learning) System

End-to-end scheme monitoring, evaluation & learning system for physical & financial progress monitoring

PFMS Integration

Integrate your Budgeting System with PFMS for financial transactions via PFMS

BI & Analytics

Analytical Dashboards

Develop inferences from your existing data and present meaningful information

Data Visualization

Visualizing your data intuitively with graphical dashboards, charts and graphs, processed data easy to understand

Decision Support Systems

Processing of multiple datasets & create a ecosystem where the management has clear visibility of the business

AI & IoT

LLM Model Integration (ChatGPT)

Using OpenAI & other opensource platforms for building your own LLM solutions

ChatBot

Don't leave your customers without the information they need, help them with 24x7 chatbots

Industry 4.0

Using the capabilities of IoT, cloud computing, enabling smart & connected devices and creating efficient production systems

Machine Learning

Track every detail about your vehicles and equipment from cradle to grave.

IoT

Track every detail about your vehicles and equipment from cradle to grave.

- Products

- Industries

- TROOLOG IQ

- Explore

.png)

.png)

.png)

.png)